32+ mortgage interest deduction cap

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. For taxpayers who use.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

10000 cap on property tax deduction.

. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. If your home was purchased before Dec. Web March 4 2022 439 pm ET.

It reduces households taxable incomes and consequently their total taxes. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Mortgage deduction limit.

The debt cant exceed 750000 or 1000000 if the loan was taken before December 16 2017 to. Web The home with the secured loan must have sleeping cooking and toilet facilities. Web IRS Publication 936.

Web The mortgage interest deduction is one of the most popular tax deductions claimed by an estimated 323 million people in 2017. Web Mortgage interest deduction limit. 750000 of home acquisition debt or 375000 if youre.

Calculate Your Monthly Loan Payment. Homeowners who bought houses before. 1 million of home acquisition debt or 500000 if youre married filing separately.

Is that a new cap. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. In the past homeowners have been legally able to deduct all state and local taxes theyve paid on all properties they.

The previous limit was 1. Ad 10 Best Home Loan Lenders Compared Reviewed. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Mortgage interest deduction limit. Comparisons Trusted by 55000000. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

See If Youre Eligible for a 0 Down Payment. Lock Your Rate Today. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage.

Married filing jointly or qualifying widow er. The 2017 tax bill set a cap on the total. Single or married filing separately 12550.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For 2021 tax returns the government has raised the standard deduction to.

Web The deduction can be claimed only for the interest paid on mortgage debt up to 750000 if the loan was taken out after Dec.

Mortgage Interest Deduction Bankrate

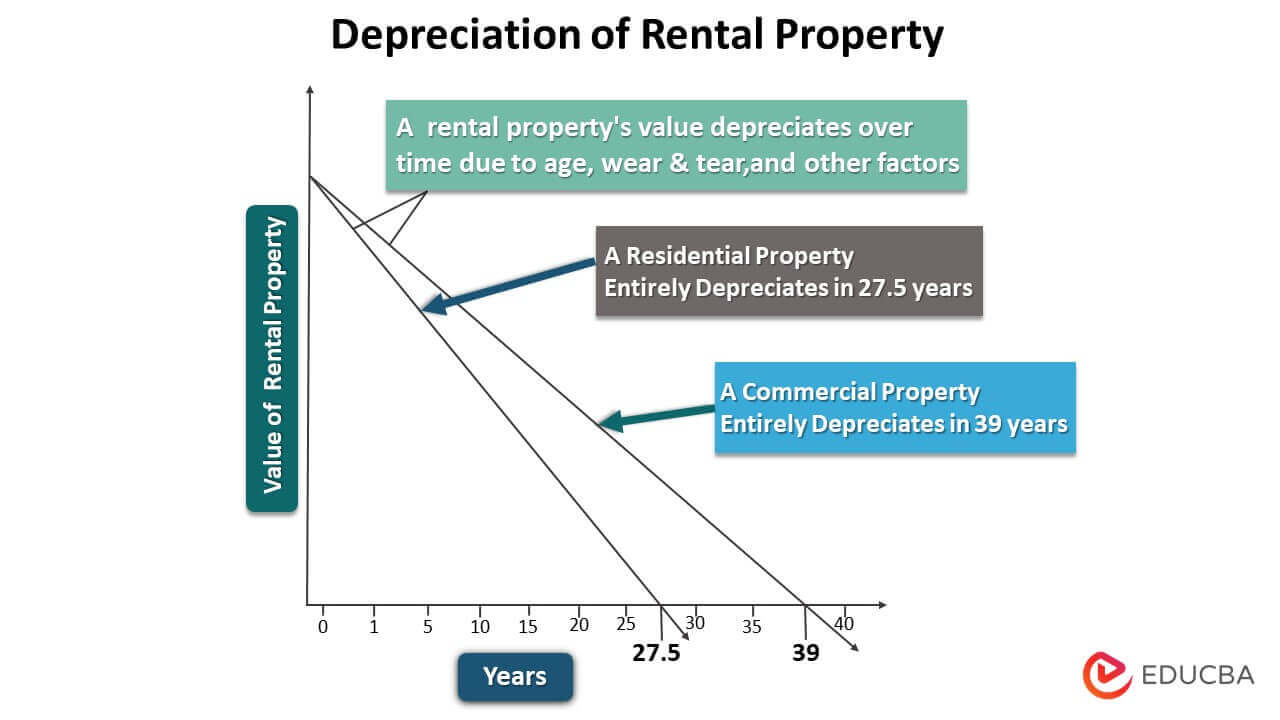

Depreciation For Rental Property How Does It Work Eligibility Examples

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Tax Deduction What You Need To Know

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

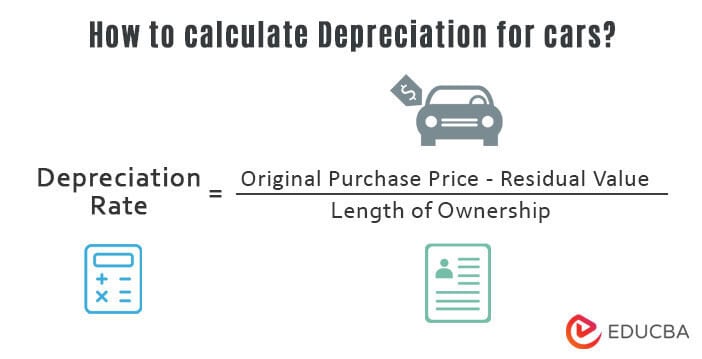

Depreciation For Cars Meaning Rates Formula Examples

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible

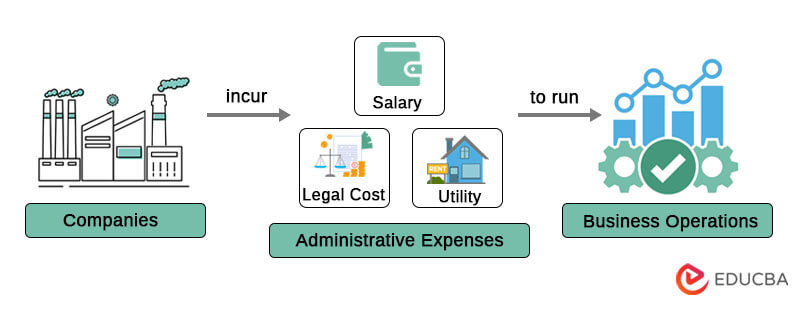

Administrative Expenses Meaning List Real Company Examples

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Obamacare Optimization Vs Tax Minimization Go Curry Cracker

Economist S View Carbon Taxes Vs Cap And Trade

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Maximum Mortgage Tax Deduction Benefit Depends On Income